The Importance of Updating Insurance as Your Business Grows

As your business expands, so do its needs. What once worked for a small startup may no longer…

As your business expands, so do its needs. What once worked for a small startup may no longer…

As veterans venture into the business world, a plethora of resources awaits them, including the Small Business Administration, Veterans Affairs Office of Small and Disadvantaged Business Utilization (OSDBU), the SCORE Veteran Fast Launch Initiative, and American Corporate Partners (ACP). Navigating the entrepreneurial landscape demands a crucial consideration—adequate insurance coverage to safeguard your veteran-owned enterprise.

Technology and the internet make our life easier. Through the use of technological advancement, internet connectivity and digital platforms connecting people across the globe have become fast, convenient, and easier. When the Covid-19 pandemic hit around the globe, technology helped us to continue our life and work and do many things virtually such as business meetings, education, shopping, socializing, and banking. Mostly, all transactions happen online that’s why it’s important to protect all vital information and keep your business data safe and secure.

As the New Year approaches, it’s the perfect time for small businesses to reflect on their achievements, challenges, and strategies for growth. Setting resolutions can pave the way for success and propel your business forward. At Klinger Insurance Group, we believe that prioritizing certain resolutions can significantly benefit small businesses in the coming year. Here are three New Year‘s resolutions that can make a profound difference:

As temperatures drop during the winter months, businesses face the risk of frozen pipes, potentially leading to severe damage, disruption of operations, and costly repairs. At Klinger Insurance Group, we understand the importance of safeguarding your business against such risks. Here's a comprehensive guide on how to prevent frozen pipes and mitigate potential damages this winter season.

Product liability insurance is a critical safeguard for manufacturers and sellers, providing protection against lawsuits stemming from the manufacturing or sale of a company's products. This coverage encompasses liability for bodily injury or property damage incurred by a third party due to a product defect or malfunction.

Non-profit organizations often operate with limited budgets, making them particularly vulnerable to significant unexpected expenses. Having appropriate insurance coverage to shield against the most significant risks is paramount for the financial well-being of non-profits.

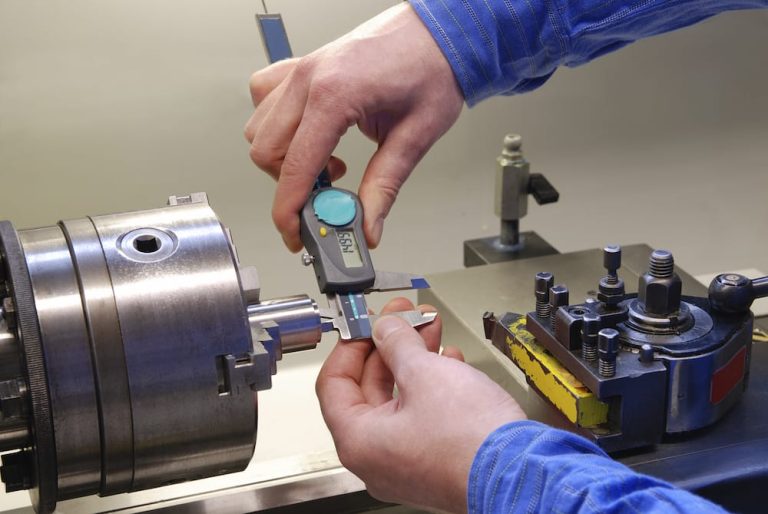

Manufacturers must secure comprehensive insurance coverage to address the unique challenges they encounter in their operations. Within the manufacturing industry, risks encompass equipment breakdowns, product recalls, and product liability claims initiated by consumers.

Your business assets hold significant value, reflecting your dedicated effort and financial investments in establishing your business premises, acquiring essential equipment, and managing inventory.

Many business owners recognize the significance of insurance coverage to safeguard their assets against risks like fire, vandalism, theft, storm damage, and various other potential threats. However, one often overlooked peril is earthquakes.