When you use Klinger Insurance Group you SAVE TIME, MONEY, and get BETTER COVERAGE

Have you ever been frustrated by your insurance company?

Frustrated with your insurance carriers or insurance agent

Lack of customer service from your agent or company

Limited Coverage Options

Unsatisfactory Claims Experience

High Premiums / Rate Increase

Complicated policy terms and unclear coverage details

What does working with Klinger Insurance Group look like?

Getting started is easy!

Start Online

Enter some basic information on our website to start.

We Shop For You

We closely review your current policy, checking for coverage levels and exclusions with our multiple carriers.

Pick The Best Plan

Choose the coverage package that fits best.

When something happens, we're there

Partnering with Klinger Insurance Group comes with numerous advantages. Our client-centric approach guarantees that your needs are always our top priority. At Klinger Insurance Group, we are your trusted insurance advisor for all your coverage requirements.

Why Choose Klinger Insurance Group?

Experience peace of mind with comprehensive protection, delivered by the experts at Klinger Insurance Group. As a veteran-owned agency, we specialize in tailored, personalized solutions for auto, home, life, and business insurance needs.

Dedicated to safeguarding Germantown and all of Maryland, our mission is to equip you with robust coverage that stands strong in the face of uncertainty. Trust in our unwavering commitment to defend what matters most to you, with a compassionate and supportive approach that honors our service-oriented roots.

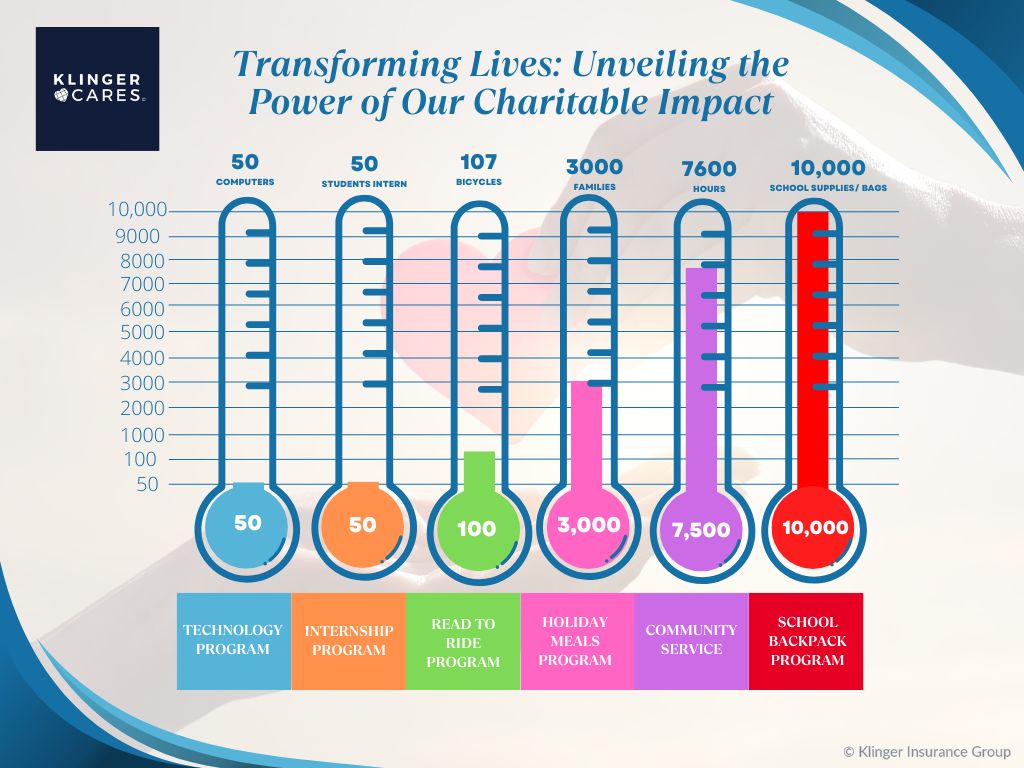

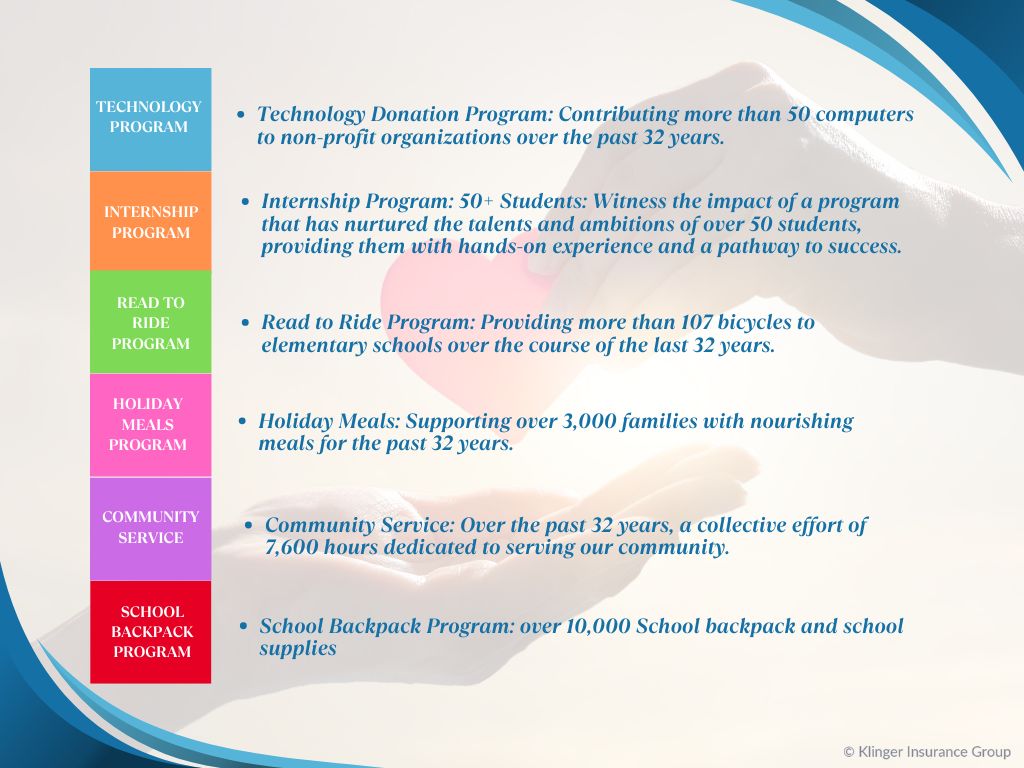

Klinger Cares

Our agency’s “Klinger Cares” initiative demonstrates our commitment to giving back to our community. As a team, we complete at least one volunteer project per month.

Take the next step, let's talk.

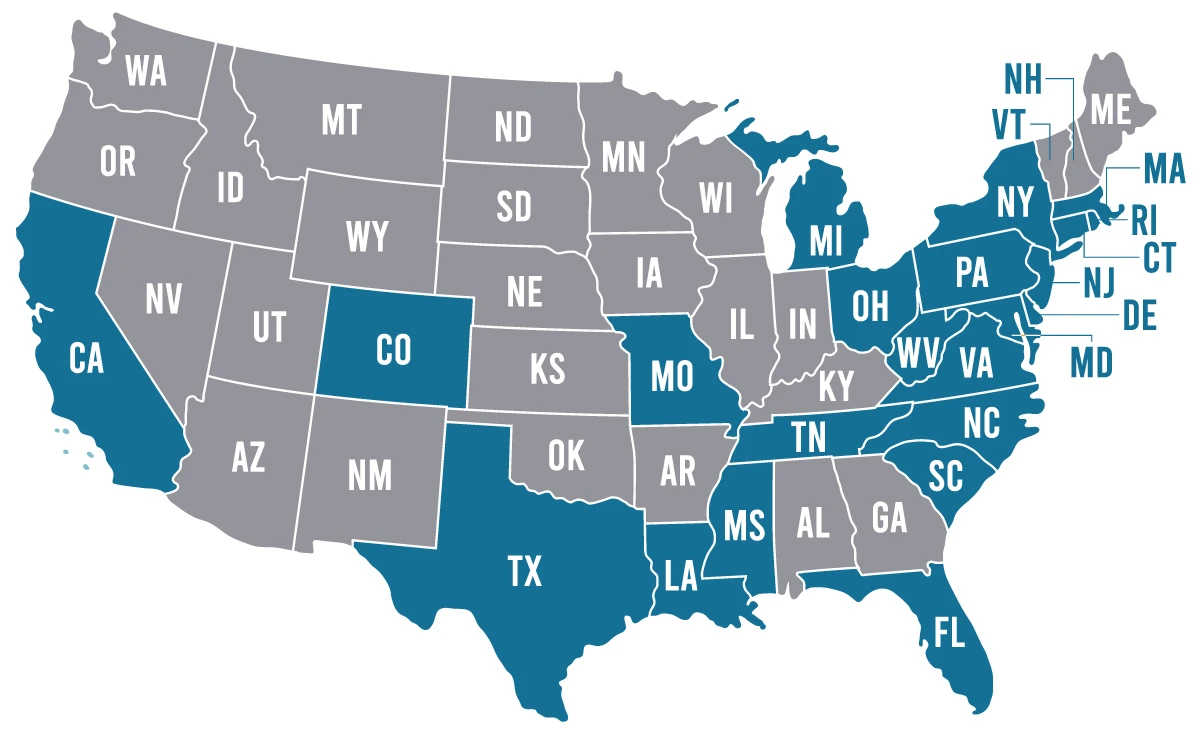

Located in Germantown, Maryland, we also serve...

Real insurance solutions, for real life situations

Our personalized approach ensures we customize coverage to your needs, protecting you and your loved ones. Let us be your trusted partner in navigating the insurance world quickly and confidently.